jersey city property tax rate 2020

Homeowners in this Bergen County borough paid an average of 16904 in property taxes last year a 182 increase over 2018. The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

State Local Property Tax Collections Per Capita Tax Foundation

Left click on Records Search.

. Camden County has the highest property tax rate in NJ with an effective property tax rate of 391. The Average Effective Property Tax Rate in NJ is 274. The average 2020 New Jersey property tax bill was 8893 an increase of 157 vs.

Dont let the high property taxes scare you away from buying a home in New Jersey. All 21 counties in. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

The average effective property tax rate in New Jersey is 242 compared with a national average of 107. Under Search Criteria type in either property location owners name or block lot identifiers. Mayor Fulop Announces Pre-registration for Youth Summer Camps Opens March 21 Locations in all 6 Wards Learn More.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. 2022 State of the City Address. To process click on Submit Search.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Ad Search County Records in Your State to Find the Property Tax on Any Address. City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel.

According to the ELC the local tax levy for the. Enter an Address to Receive a Complete Property Report with Tax Assessments More. Real property is required to be assessed at some percentage of true value established by the county board of taxation in each county.

Each business day By Mail - Check or money order to. Under Tax Records Search select Hudson County and Jersey City. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 621 7 717 7 7 5171 7 81 252 81 967 73.

According to the Education Law Center Jersey Citys local fair share is about 532 million. Implementing legislation is found in New Jersey Statutes Annotated Title NJSA. Mayor Fulop Announces First Round of Grants to Quadruple Critical Funds for Local Artists Arts Organizations and Educational Programming Learn More.

Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. County Equalization Tables.

Eduardo CToloza CTA City Assessor. ARP aid expires in 2024. Tax Assessor Phone Numbers NEW -- NJ Property Tax Calculator NEW -- Historical New Jersey Property Tax Rates.

PAY PROPERTY TAXES Online In Person - The Tax Collectors office is open 830 am. 78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in 2020. When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400.

Jersey City was allocated 146 million in total ARP aid. Description The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. 10 25 50 75 100 All.

What is the Average Property Tax Rate in NJ. S010976 s02 2031. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Lawsuit Alleges Developer of NJs Tallest Building is Defrauding Condo Purchasers 124 Residences Event Space and New School Planned for Jersey Citys Sacred Heart Site Jersey Citys Broa Moving to Historic House on Grove Street. The average 2020 New Jersey property tax bill was 8893 an increase of 157 from the previous year. Property tax rates are the rate used to determine how much property tax you pay based on the assessed value of your property.

Mayor Fulop Advances Jersey Citys. 587 rows County 2021 Average County Tax Rate 2020 Average County Tax Bill. Tax rates towncityborough rate per 100 sid.

While Cape May County has the lowest property tax.

Property Taxes By State Embrace Higher Property Taxes

Mark Fernald Why Your Property Taxes Are So High

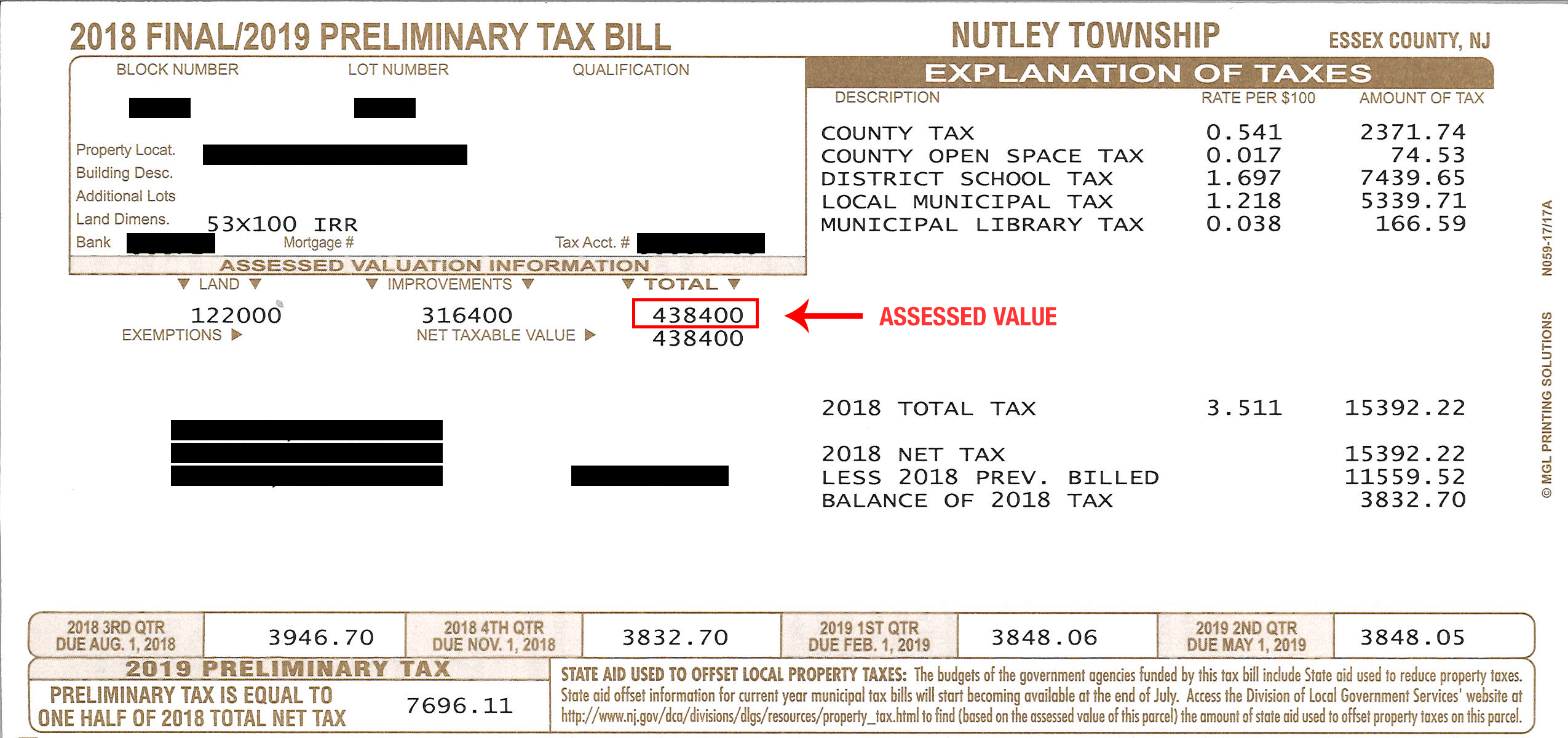

Here S The Average Property Tax Bill In Belleville Nutley Belleville Nj Patch

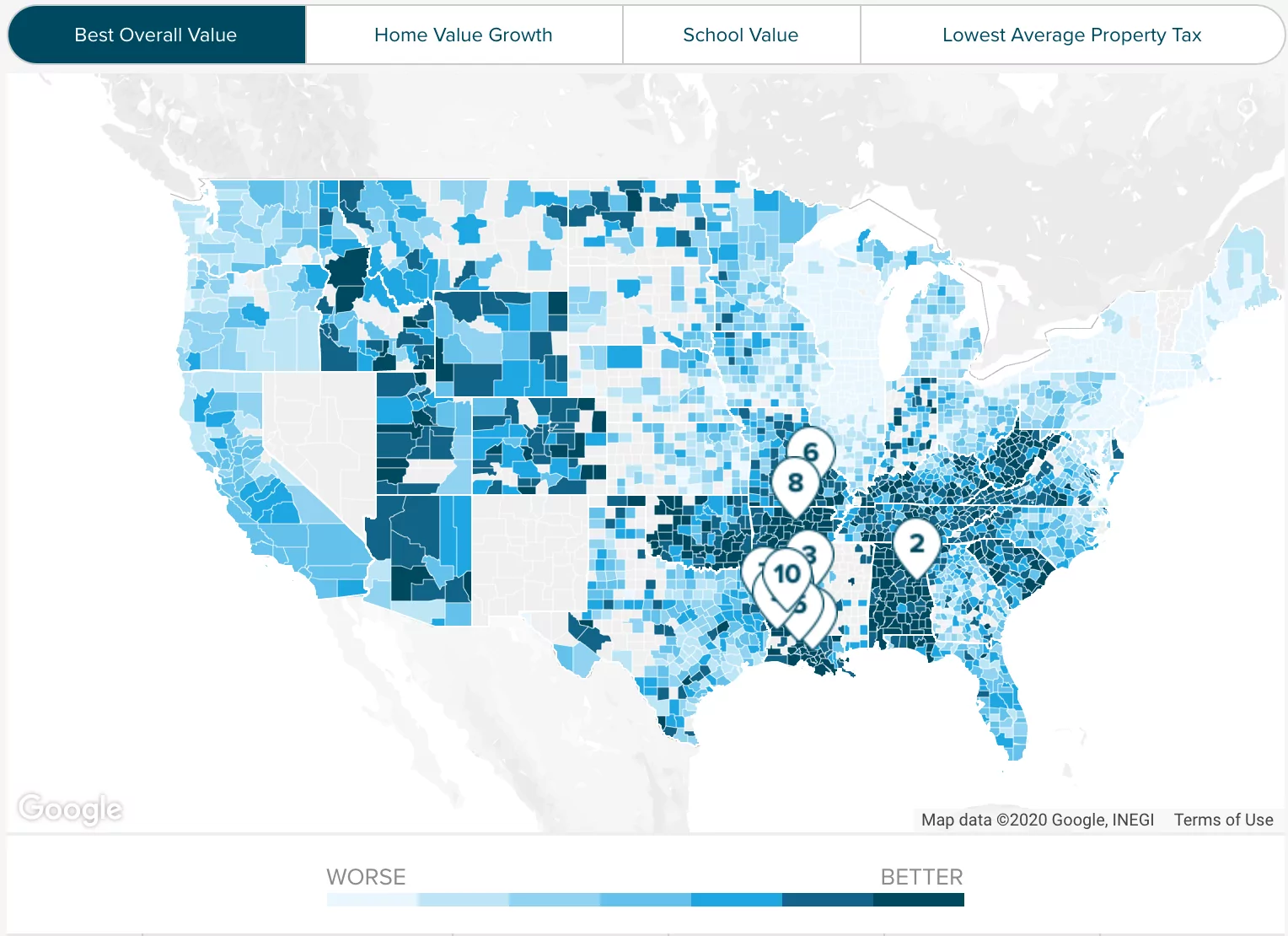

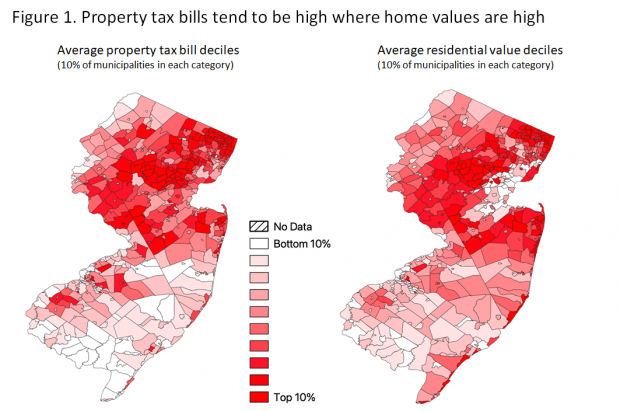

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Bills

Property Tax Prorations Case Escrow

Property Tax Comparison By State For Cross State Businesses

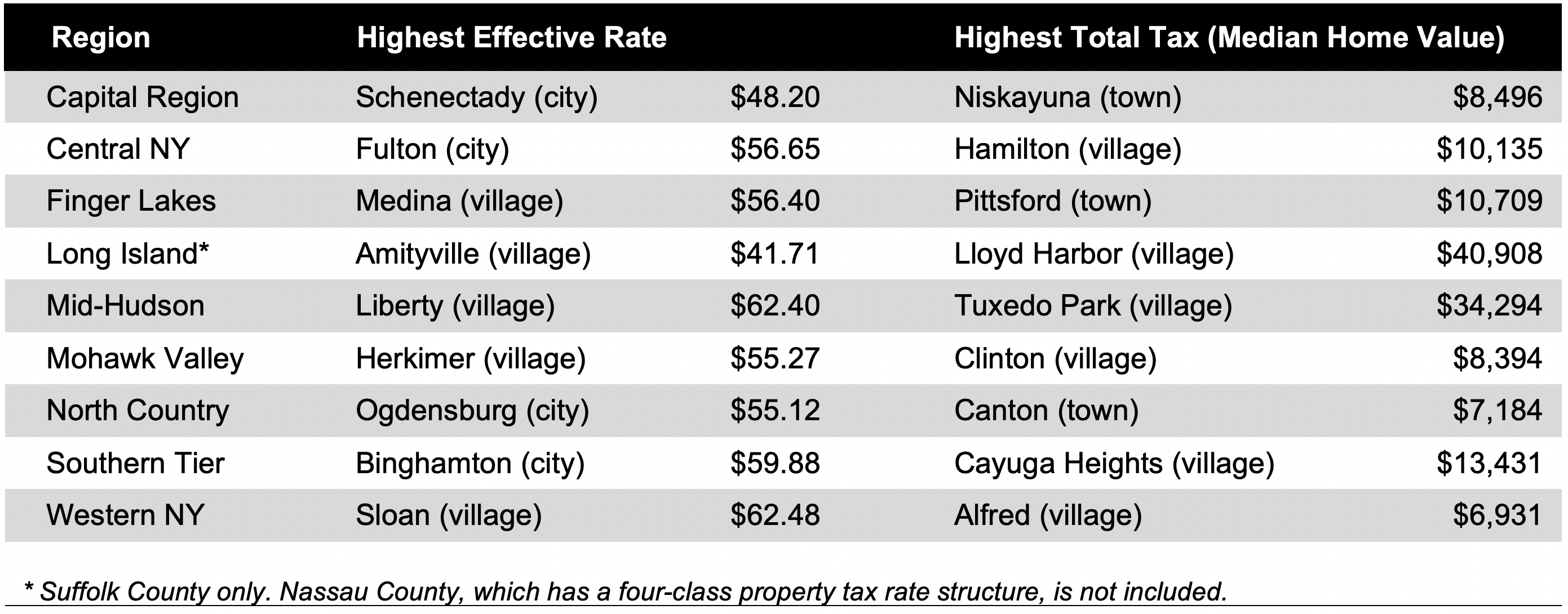

New York Property Tax Calculator 2020 Empire Center For Public Policy

The Official Website Of City Of Union City Nj Tax Department

Hennepin County Mn Property Tax Calculator Smartasset

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Township Of Nutley New Jersey Property Tax Calculator

The Ten Lowest Property Tax Towns In Nj

Property Taxes By State County Lowest Property Taxes In The Us Mapped